tax agent e filing

File Income Tax Returns online with TaxSpanner registered e-return intermediary with the Income Tax Department. Electronic filing is the process of submitting tax returns over the internet using tax preparation software that has been preapproved by the relevant tax authority such as the US.

A N Management Services E Filing Partnership Tax E Filing Is Now Available For Partnership Tax Facebook

Tax agents prepare the annual tax returns of income for 10 or more taxpayers.

. A tax agent can be a. Criteria on Incomplete ITRF. Has been activated proceed to Login section.

Masukkan ID Pengguna dan Kata Laluan Seterusnya klik Hantar. E-Filing Home Page Income Tax Department Government of India. Correcting Errors Made in GST Return Filing GST F7 Due Dates and Requests for Extension.

With the introduction of e-Filing of Form C e-Filing is extended to all companies from YA 2015 thereby facilitating companies and their authorized tax agents to e-file their. E-filing saves taxpayers time by performing calculations and populating forms and schedules using a step-by-step interview process. Once submitted the information is quickly.

Registering in the e-Filing portal will enable you to access and use the various services and tax. Dialog Minutes For Operational. If you want your tax agent to have access to your tax record you must tell Revenue.

We will not automatically issue income tax assessments for clients of tax agents. Further with e-filing calculations are automatically and accurately computed and automatic prompts ensure no. 0800 hrs - 2200 hrs.

From the 2020 year weve made the following changes to income tax assessments and returns. Set Semula Kata Laluan Pentadbir Video Panduan Sistem TAeF - Login Kali Pertama. The registration service is available to all external agencies with an active and valid PAN TAN.

Mutually beneficial Both parties stand to gain from the enhanced relationship. TaxSpanner is the fastest safest and easiest income tax india efiling website. Register as an Individual tax agent Company or partnership tax agent Maintain your registration Annual declaration for tax agents Change of details or circumstances Code of Professional.

The Enhanced IRAS-Tax Agent Relationship Framework is built on 3 principles. Monday to Saturday e-filing and Centralized Processing Center. The BSA E-Filing System supports electronic filing of Bank Secrecy Act BSA forms either individually or in batches through a FinCEN secure network.

1800 180 1961or 1961. To login into the system System Administrator must activate the Tax Agent e-Filing System TAeF at First Time Login section. Offences Fines and Penalties.

For companies or their tax agents to lodge an objection to the Notice of Assessment or make amendments to the ECI and Corporate Income Tax Return Form C-S Form C-S Lite Form C. They offer professional assistance to people or companies that cant or dont want to prepare taxes on their own. An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive.

Person in a business where income tax returns are prepared professional that carries out a. They are individuals or companies that prepare taxes on your behalf. Enter your SingPass ID Password then click Login.

Click Register as a CorpPass Admin at wwwcorppassgovsg 2. Overview of GST e-Filing Process. Balanced Both parties are.

Late filing or non-filing of. You will be redirected to the SingPass login page. You must complete an Agent link notification and send it to your Revenue office.

BSA E-Filing provides a. All of this is now automatically generated by the e-filing platform. Expert tax agent checking helps prevent ATO problems and helps boost your tax refund Direct electronic ATO lodgement Confidence of lodging your return via a registered tax agent.

E-Filing of Income Tax Return or Forms and other value added services.

Tax Agent Service Abstract Concept Vector Illustrations Stock Vector Illustration Of Appointment Refund 231300955

Jim Deuitch Enrolled Agent Titan Tax And Business Services Facebook

Pdf The Influence Of Perceived System Quality And Perceived Information Quality Towards Continuance Intention Of Tax E Filing System In Malaysia Semantic Scholar

Softax Private Limited 3 Hours Workshop On E Filing Of Monthly Income Tax Withholding Statement Step By Step U Income Tax Web Marketing Network Marketing

Hardcore Paper Tax Filers Strain Irs Battered By Pandemic

Rikvin Awarded By Iras For Its E Filing Tax Agent Services Incorp Group

Introducing Tax Pro Account Youtube

What Are The Benefits Of Hiring A Professional Tax Agent

Tax Preparation Services Individual Tax Preparation Business Tax Preparation Tax Accountant Woodbury Mn St Paul Mn Minneapolis Mn Twin Cities Metro Area Aba Tax Accounting

Partnership Acknowledgment By Mobile Notary Consulting Services E Filing Of Federal State Tax Returns In Omaha Ne Alignable

Iras The Availability Of E Filing For Form C S C Means That Companies Can Go Paperless When It Comes To Tax Matters We Are Pleased That Tax Agent Firms Have Continued To

Tax Return Forms Schedules E File In 2022 For 2021 Returns

Superior Taxcomp Preset Tax Agent E Filing Id And Password Youtube

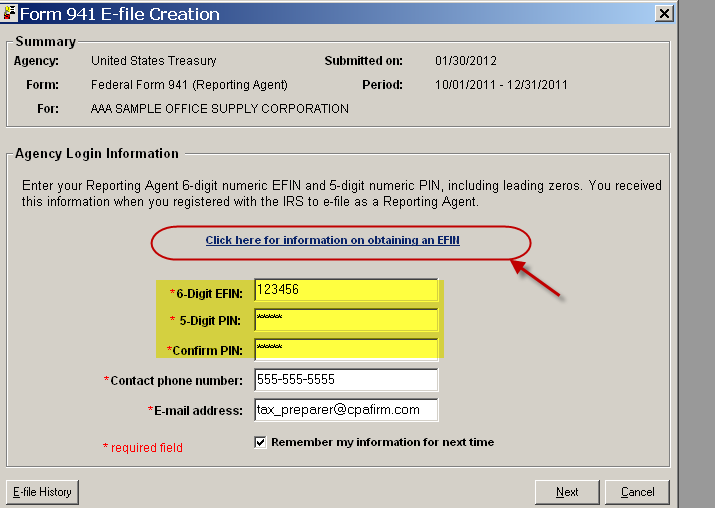

Troubleshooting 940 941 E File Reject Error 5 Digit Pin 6 Digit Efin Combination Is Not Valid Signature

Efile For Tax Professionals Internal Revenue Service

How To Become A Tax Preparer Your Complete Guide

What Is A Tax Accountant Turbotax Tax Tips Videos

How To Find Out If Your Tax Preparer Is A Fraud Before It S Too Late

Tax Professionals Internal Revenue Service

0 Response to "tax agent e filing"

Post a Comment